How to Get an Atm https://alloansonline.com/lenders-loan/pesomaxy/ Salary Loan Baguio City

Getting an atm salary loan baguio city is an easy and fast way to get funds when you need them. Whether you need money for an urgent situation or want to upgrade your home, this is a great option. There are a number of lending agencies that provide this service, and you can apply online for one with ease. However, before you decide on a lender, it’s important to do some research.

Unlike banks and other financial companies, this type of loan does not require collateral to be approved. This means that you can borrow money even if you have bad credit. The perks of this kind of loan are that it is quick and convenient, and you can borrow again and again without hassles.

This is a common practice for people who have a poor credit score but need money quickly. This is especially true for those who need to pay medical bills or emergency expenses.

The first thing you need to do is to find a trustworthy company. This can be done by checking their website. Most of these companies have a comparison tool that allows you to see the rates and terms of their services. You can also check out their testimonials.

Another important part of the process is to read the terms and conditions carefully. You will want to know the repayment plan, and how much you need to pay back every month. This will help you determine how much money you need to borrow, and if it will be an affordable solution for your budget.

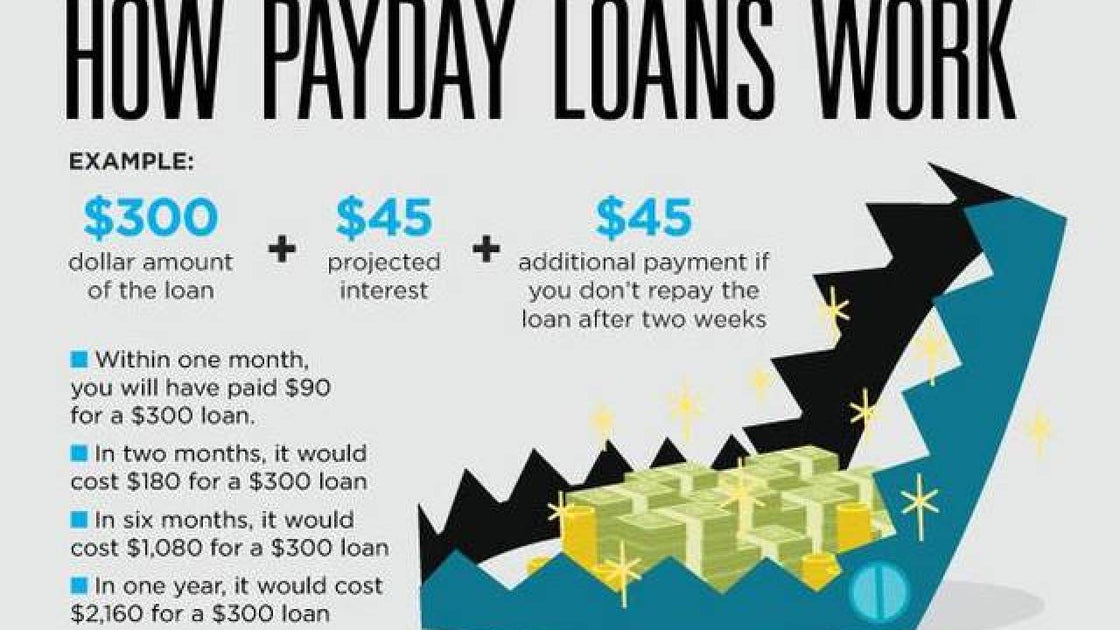

You should also understand that https://alloansonline.com/lenders-loan/pesomaxy/ this type of loan has a high interest rate. This is why you should only borrow from a legitimate lender.

There are several lenders in the Philippines who offer this type of loan. If you want to avoid falling into the trap of these scammers, it is best to stick with official Philippine banks and credit companies.

If you need a loan for emergencies, it is best to look for a reliable lending agency that offers cash loans at reasonable rates. These firms are known to offer fast and easy cash loans, and they are available 24 hours a day.

They also have a variety of financing options for people who need emergency loans. Some of them include quick cash loans, e-salary loans, and online loans.

These companies also have mobile applications, so you can apply for a loan from the comfort of your home. Most of these apps allow you to borrow from anywhere in the world and receive the funds instantly.

Some of these lenders also offer a revolving credit line, which can be useful for those who need to make large purchases. You can also use these loans to pay off your other debts.

A salary loan can be a great option for those who need to take care of an emergency, but it’s not a good idea to use it if you don’t have the cash. If you can’t afford the payments, it will only make matters worse.